Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

This time every year, homeowners who are planning to move have a decision to make: sell now or wait until after the holidays? Some sellers with homes already on the market may even remove their listing until the new year.

But the truth is, many buyers want to purchase a home for the holidays, and your house might be just what they’re looking for. As an article from Fortune Builders explains:

“ . . . while a majority of people take a step back from the real estate market during the holiday months, you may find when the temperature drops, your potential for a great real estate deal starts to rise.”

To help prove that point, here are four reasons you shouldn’t wait to sell your house.

1. The desire to own a home doesn’t stop during the holidays. While a few buyers might opt to delay their moving plans until January, others may need to move now because something in their life has changed. The buyers who look for homes at this time of year are usually motivated to make their move happen and are eager to buy. A recent article from Investopedia says:

“Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer. Putting your home on the market at this time of year and attracting a serious buyer can often result in a quicker sale.”

2. While the supply of homes for sale has increased a little bit lately, overall inventory is still lower than it was before the pandemic. What does that mean for you? If you work with an agent to price your house at market value, it could still sell quickly because today’s buyers are craving more options – and your home may be exactly what they’re searching for.

3. You can determine the days and times that are most convenient for you for home showings. That can help you minimize disruptions to your own schedule, which can be especially important during this busy time of year. Plus, you may find buyers are more flexible on when they’ll tour a house this time of year because they have more time off from work around the holidays.

4. And finally, homes decorated for the holidays appeal to many buyers. For those buyers, it’s easy to picture gathering with their loved ones in the home and making memories of their own. An article on selling at this time of year offers this advice:

“If you’re selling around a holiday and have decorations up, make sure they accent—not overpower—a room. Less is more.”

Bottom Line

There are plenty of good reasons to put your house on the market during the holiday season. Let’s chat and see if it’s the right time for you to sell.

Thinking About Using Your 401(k) To Buy a Home?

Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? You’re not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why.

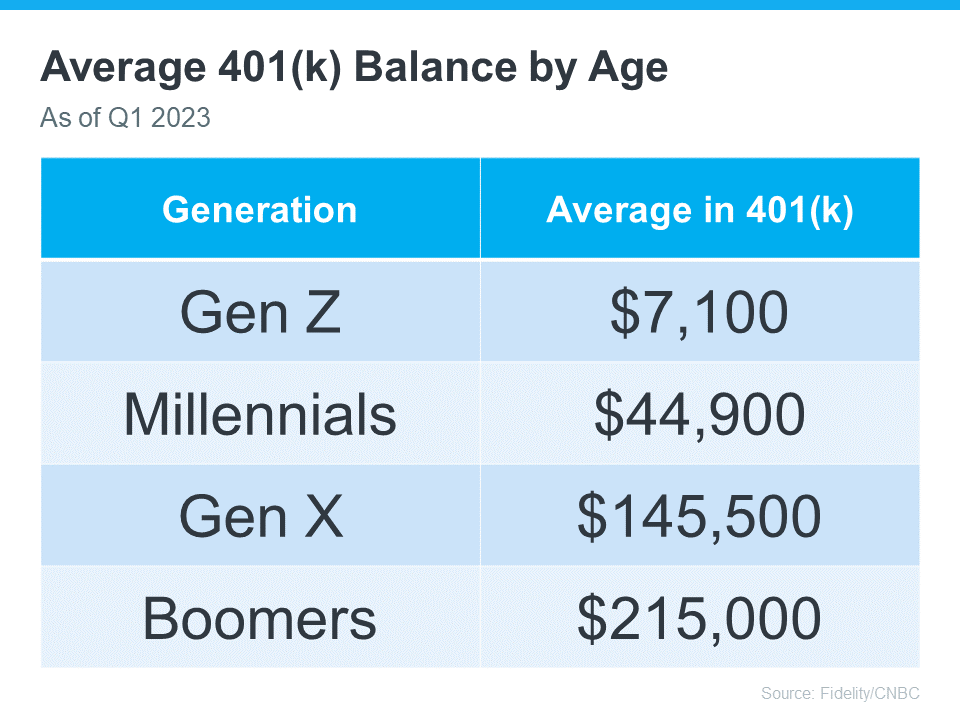

The Numbers May Make It Tempting

The data shows many Americans have saved a considerable amount for retirement (see chart below):

It can be really tempting when you have a lot of money saved up in your 401(k) and you see your dream home on the horizon. But remember, dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That’s why it’s important to explore all your options when it comes to saving for a down payment and buying a home. As Experian says:

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Using your 401(k) is one way to finance a home, but it’s not the only option. Before you decide, consider a couple of other methods, courtesy of Experian:

- FHA Loan: FHA loans allow qualified buyers to put down as little as 3.5% of the home’s price, depending on their credit scores.

- Down Payment Assistance Programs: There are many national and local programs that can help first-time and repeat homebuyers come up with the necessary down payment.

Above All Else, Have a Plan

No matter what route you take to purchase a home, be sure to talk with a financial expert before you do anything. Working with a team of experts to develop a concrete plan prior to starting your journey to homeownership is the key to success. Kelly Palmer, Founder of The Wealthy Parent, says:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Bottom Line

If you’re still thinking about using your 401(k)-retirement savings for a home down payment, consider all your options and work with a financial professional before you make any decisions.

Reasons To Sell Your House Before the New Year

🏡 As the year winds down, you may have decided it’s time to make a move and put your house on the market. But should you sell now or wait until January?

Affordable Homeownership Strategies for Gen Z

🏡 The idea of affordable homeownership has always been a big part of the American Dream. It’s a symbol of stability, independence,

Spooky features to add value this Halloween

👻 The scariest night of the year is upon us so here’s a look at the most terrifying renovations to add value to your home this Halloween.

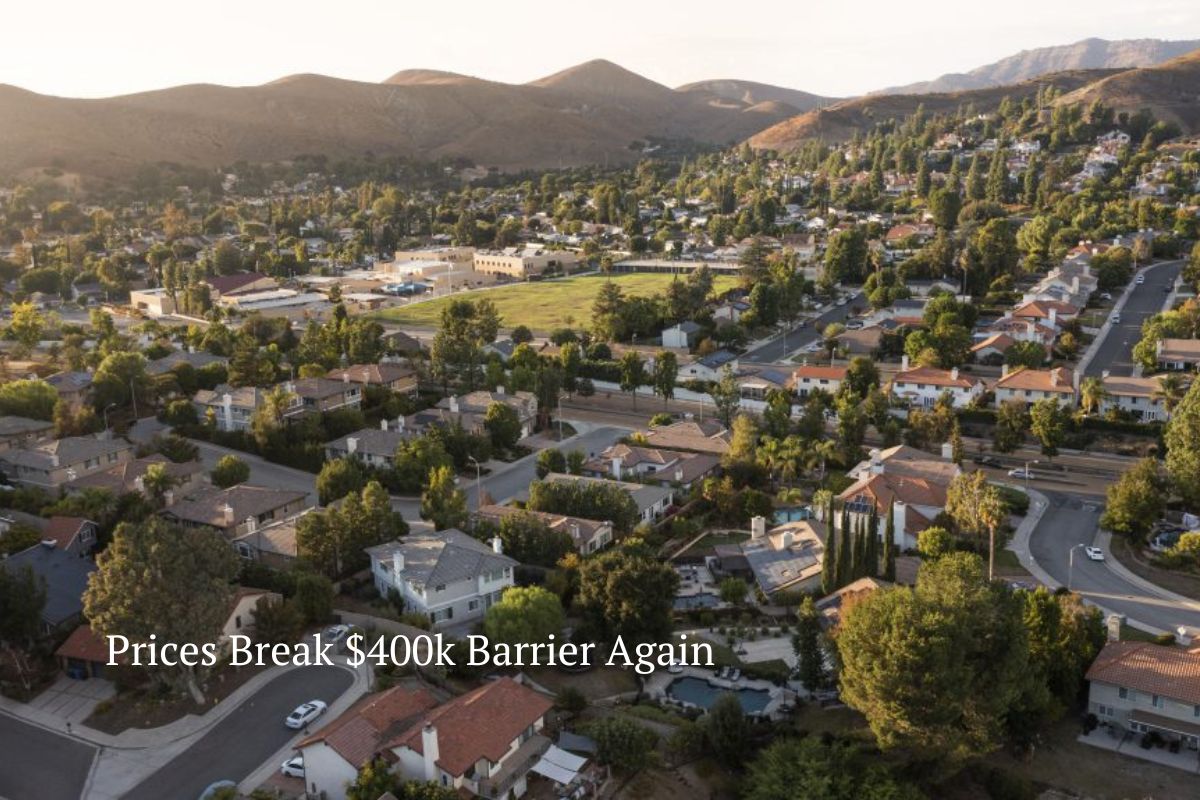

Prices Break $400k Barrier Again

💸 American property prices continue to defy the gravity of higher mortgage costs with values rising for a fifth consecutive month.

Your Home Equity Can Offset Affordability Challenges

📊 Mortgage rates may be making you wonder if selling is the right decision. Here’s what you need to know about how home equity can help.

Why Is Housing Inventory So Low?

🏡 Why is it so hard to find a house to buy? And while it may be tempting to wait it out until you have more options, that’s probably not the best strategy. Here’s why.

Get Ready for Smaller, More Affordable Homes.

🏡 In some ways, smaller homes are already here. When the pandemic hit, the meaning of home changed. People needed the space their home provided not only as a place to live, but as a place to work, go to school, exercise, and more.

Expert Home Price Forecasts Revised Up for 2023

📈 Toward the end of last year, there were a number of headlines saying home prices were going to fall substantially in 2023

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link