Ways Your Home Equity Can Help You Reach Your Goals

If you’ve owned your house for at least a couple of years, there’s something you’re going to want to know more about – and that’s home equity. If you’re not familiar with that term, Freddie Mac defines it like this:

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.”

That means your equity grows as you pay down your home loan over time and as home values climb. While it’s true home prices dipped slightly last year, they rebounded and have been climbing in many areas since then. Here’s why that price growth is good news for you.

In the latest Equity Insights Report, Selma Hepp, Chief Economist at CoreLogic, explains:

“With price gains continuing to help homeowners build wealth, equity has reached a new high and regained losses that resulted from declines last year. And while the average U.S. homeowner gained over $20,000 in additional equity compared with the third quarter of 2022, some markets are seeing larger increases as price growth catches up.”

And that figure is just for the last year. To help you really understand how that number can add up over time, the report also says the average homeowner with a mortgage has more than $300,000 in equity. That much equity can have a big impact.

Here are a few examples of how you can put your home equity to work for you.

1. Buy a Home That Fits Your Needs

If your current space no longer meets your needs, it might be time to think about moving to a bigger home. And if you’ve got too much space, downsizing to a smaller one could be just right. Either way, you can put your equity toward a down payment on something that fits your changing lifestyle.

2. Reinvest in Your Current Home

And, if you’re not ready to move just yet, you can use the equity you have to improve your current home. But it’s important to consider the long-term benefits certain upgrades can bring to your home’s value. A real estate agent is a great resource on which projects to prioritize to get the greatest return on your investment when you sell later on.

3. Pursue Personal Ambitions

Home equity can also serve as a catalyst for realizing your life-long dreams. That could mean investing in a new business venture, retirement, or funding an education. While you shouldn’t use your equity for unnecessary spending, using it responsibly for something meaningful and impactful can really make a difference in your life.

4. Understand Your Options to Avoid Foreclosure

While the number of foreclosure filings remains below the norm, there are still some homeowners who go into foreclosure each year. If you’re in a tough spot financially, having a clear understanding of your options can help. Equity can act as a cushion if you’re not able to make your mortgage payments on time.

Bottom Line

If you want to know how much equity you have in your home, let’s connect. That way you have someone who can do a professional equity assessment report on how much you’ve built up over time. Then let’s talk through how you can use it to help you reach your goals.

Down Payment Assistance Programs Can Help Pave the Way to Homeownership

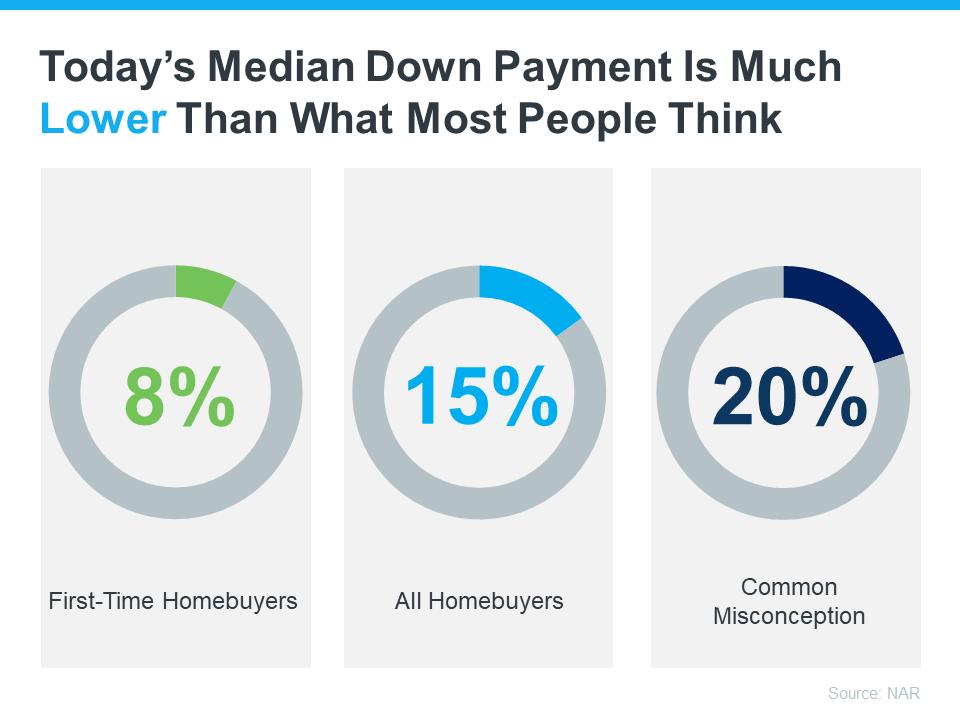

If you’re looking to buy a home, your down payment doesn’t have to be a big hurdle. According to the National Association of Realtors (NAR), 38% of first-time homebuyers find saving for a down payment the most challenging step. But the reality is, you probably don’t need to put down as much as you think:

Data from NAR shows the median down payment hasn’t been over 20% since 2005. In fact, the median down payment for all homebuyers today is only 15%. And it’s even lower for first-time homebuyers at 8%. But just because that’s the median, it doesn’t mean you have to put that much down. Some qualified buyers put down even less.

For example, there are loan types, like FHA loans, with down payments as low as 3.5%, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants. But let’s focus in on another valuable resource that may be able to help with your down payment: down payment assistance programs.

First-Time and Repeat Buyers Are Often Eligible

According to Down Payment Resource, there are thousands of programs available for homebuyers – and 75% of these are down payment assistance programs.

And it’s not just first-time homebuyers that are eligible. That means no matter where you are in your homebuying journey, there could be an option available for you. As Down Payment Resource notes:

“You don’t have to be a first-time buyer. Over 39% of all [homeownership] programs are for repeat homebuyers who have owned a home in the last 3 years.”

The best place to start as you search for more information is with a trusted real estate professional. They’ll be able to share more information about what may be available, including additional programs for specific professions or communities.

Additional Down Payment Resources That Can Help

Here are a few down payment assistance programs that are helping many of today’s buyers achieve the dream of homeownership:

- Teacher Next Door is designed to help teachers, first responders, health providers, government employees, active-duty military personnel, and veterans reach their down payment goals.

- Fannie Mae provides down-payment assistance to eligible first-time homebuyers living in majority-Latino communities.

- Freddie Mac also has options designed specifically for homebuyers with modest credit scores and limited funds for a down payment.

- The 3By30 program lays out actionable strategies to add 3 million new Black homeowners by 2030. These programs offer valuable resources for potential buyers, making it easier for them to secure down payments and realize their dream of homeownership.

- For Native Americans, Down Payment Resource highlights 42 U.S. homebuyer assistance programs across 14 states that ease the path to homeownership by providing support with down payments and other associated costs.

Even if you don’t qualify for these types of programs, there are many other federal, state, and local options available to look into. And a real estate professional can help you find the ones that meet your needs as you explore what’s available.

Bottom Line

Achieving the dream of having a home may be more within reach than you think, especially when you know where to find the right support. To learn more about your options, let’s connect.

When You Sell Your House, Where Do You Plan To Go?

If you’re thinking about selling your house, you may have heard the supply of homes for sale is still low, and that means your house should stand out to buyers who are craving more options. But you may also be wondering, once you sell, how does the current supply impact your own move? And, will you be able to find a home you want to buy with inventory this low?

One thing that can help you find your next home is exploring all your options, including both homes that have been lived in before as well as newly built ones. Let’s look at the benefits of each one.

The Pros of Newly Built Homes

First, let’s look at the advantages of purchasing a newly constructed home. With a brand-new home, you’ll be able to:

- Create your perfect home. If you build a home from the ground up, you’ll have the option to select the custom features you want, including appliances, finishes, landscaping, layout, and more.

- Cash-in on energy efficiency. When building a home, you can choose energy-efficient options to help lower your utility costs and reduce your carbon footprint.

- Minimize the need for repairs. Many builders offer a warranty, so you’ll have peace of mind on unlikely repairs. Plus, you won’t have as many little projects to tackle.

- Have brand new everything. Another perk of a new home is that nothing in the house is used. It’s all brand new and uniquely yours from day one.

The Pros of Existing Homes

Now, let’s compare that to the perks that come with buying an existing home. With a pre-existing home, you can:

- Explore a wider variety of home styles and floorplans. With decades of homes to choose from, you’ll have a broader range of floorplans and designs available.

- Join an established neighborhood. Existing homes give you the option to get to know the neighborhood, community, or traffic patterns before you commit.

- Enjoy mature trees and landscaping. Established neighborhoods also have more developed landscaping and trees, which can give you additional privacy and curb appeal.

- Appreciate that lived-in charm. The character of older homes is hard to reproduce. If you value timeless craftsmanship or design elements, you may prefer an existing home.

The choice is yours. When you start your search for the perfect home, remember that you can go either route – you just need to decide which features and benefits are most important to you. As an article from The Mortgage Reports says:

“When building, you gain more freedom to tailor the design, materials, and features, but it demands more time and involvement. Conversely, buying an established home offers immediate occupancy . . . yet may require compromises. Your choice should align with your budget, timeline, customization preferences, and the local real estate landscape.”

Either way, working with a local real estate agent throughout the process is mission-critical to your success. They’ll help you explore all of your options based on what matters most to you in your next home. Together, you can find the home that’s right for you.

Bottom Line

If you have questions about the options in our area, let’s discuss what’s available and what’s right for you. That way you’ll be ready to make your next move with confidence.

2024 Housing Market Forecast [INFOGRAPHIC]

- Thinking of buying or selling a house and wondering what the new year holds for the housing market? Experts forecast home prices to end this year up 2.8% and to rise another 1.5% in 2024. And climbing prices help make homeownership a good investment.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link